The Value Added Tax (VAT) is a tax applicable to operations carried out or consumed in the territory by persons liable to VAT, with the exception of exempt products.

The VAT rate applied in Madagascar is generally 20%. However, the rate for exports of goods and services is 0%.

Persons subject to VAT in Madagascar

Individuals or legal entities with an annual turnover of at least MGA 400,000,000 excluding tax, according to the current Finance Act, are subject to VAT. The new companies planning to realize a turnover of more than MGA 400 000 000 as of their creation are subjected to the VAT.

Under the new provisions of the Amending Finance Act 2020, a company may be subject to IR without being subject to VAT.

Taxpayers with a turnover below this threshold will be able to be subject to VAT after making an application to the tax authorities. Thus, they will be allowed to collect VAT but will be required to keep regular accounts.

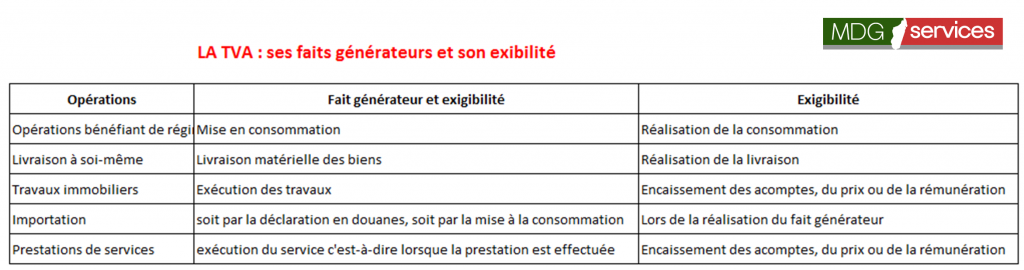

Taxable events and VAT liability :

A transaction cannot be declared for VAT if the chargeable event and the condition of payability are not met. They also determine the period of taxation of the VAT.

Calculation and declaration of VAT:

Every person subject to VAT is required to file the return by the 15th of the month following the tax period.

The calculation of the VAT payable is as follows:

VAT payable = output VAT – input VAT

Collected VAT consists of the amount of VAT mentioned in the taxpayer’s invoices for the sale of goods or services.

On the other hand, the deductible VAT is the sum of the VAT included in the purchase invoices.

The resulting tax may consist of either a VAT payment or a VAT credit. The VAT credit can be claimed as a credit refund for those who are entitled to it.

The components of a VAT return are available in the file Format_annexe_tva

The VAT credit refund (CTVA):

The application for VAT credit refund can be made by free trade companies, exporters, lessors and investors subject to VAT.

The deadline for requesting a VAT refund is 3 months. After this period, the VAT will be charged to the taxpayer as much for the refund of rejected VAT (in case of irregular invoices or transactions not in accordance with the activity of the company).

The deadline for VAT credit refunds is 60 days after the application is filed.

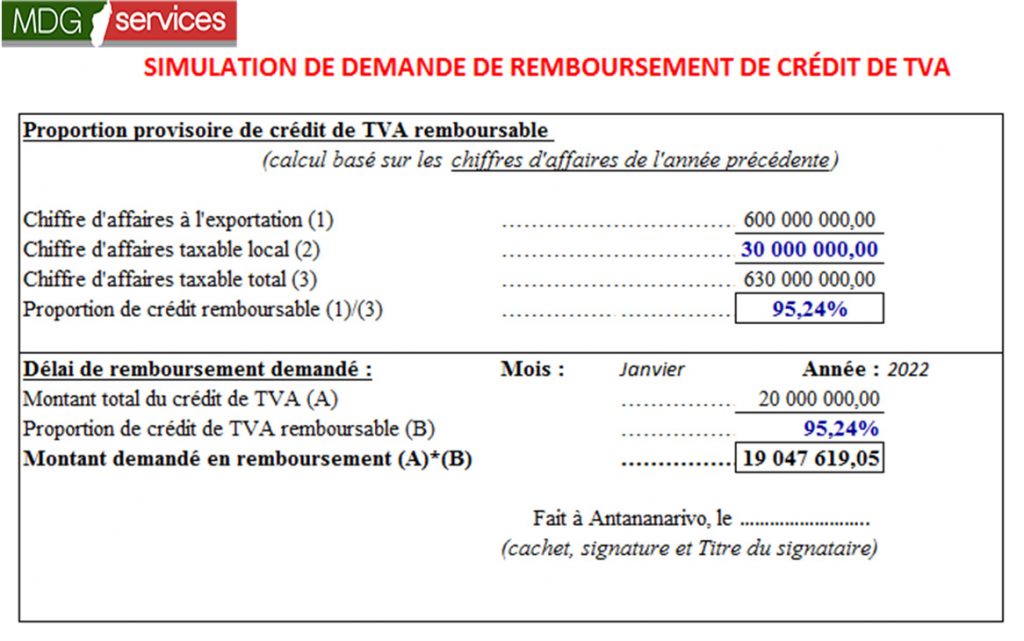

The following simulation shows us how to calculate the amount of refundable VAT

Intermittent VAT (VATI):

In accordance with article 06.01.09 bis of the General Tax Code, services performed by a service provider with no establishment in Madagascar are subject to intermittent VAT or VATI. The collected VAT is to be paid by its accredited local representative. Otherwise, the beneficiary of the service must pay the corresponding tax.

VATI at the rate of 20% is deductible from the recipient of the service according to the general rule of deduction.

Whether you are a company or an individual, benefit from a tax assistance in Madagascar including the management of your declarations and possibly the request for VAT credit refund, by contacting MDG Services.