Do you understand the recent changes to the foreign exchange code in Madagascar? Do you want to know how these changes might affect your financial operations?

It is important to note that Madagascar’s foreign exchange code has recently been modified. MDG Services is here to help you navigate these new regulations.

Modifications to the Foreign Exchange Code in Madagascar

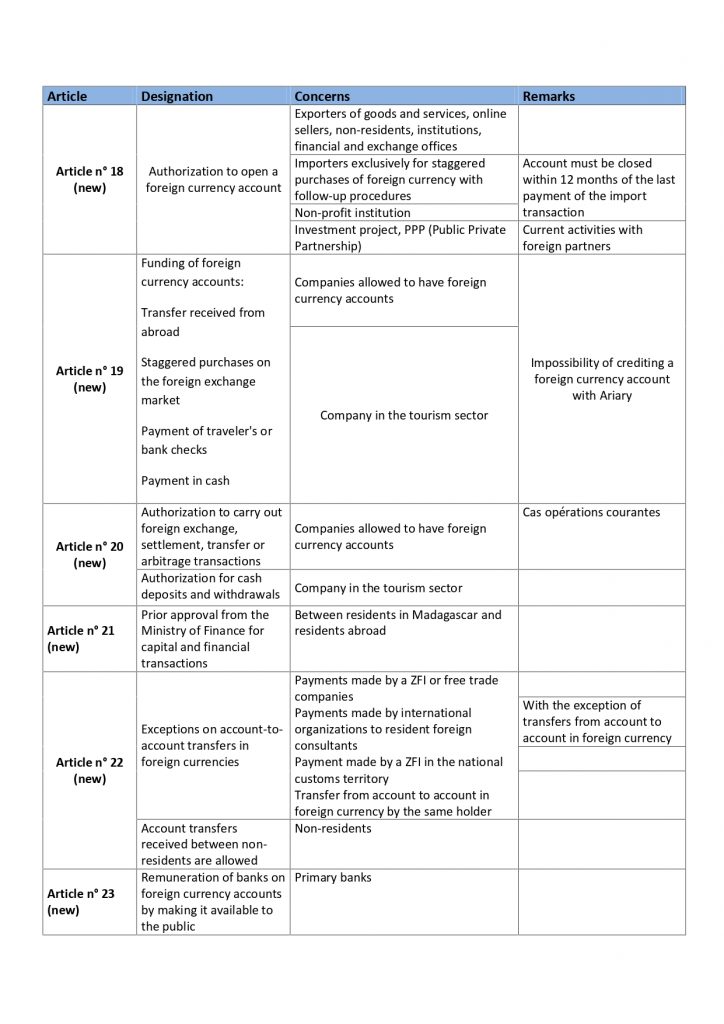

Foreign exchange operations play a crucial role in our country’s economic growth. Therefore, the monetary authorities implement an economic policy that influences the exchange of national currency for foreign currencies. The decree 2009-048 of January 12, 2009, which defined the application procedures for the foreign exchange code in Madagascar, has been amended. In other words, with the introduction of the new decree n°2022-1183 on November 28, 2022, you will notice some modifications. In summary, articles 18, 19, 20, 21, 22, and 23 of the previous decree have been revised.

Key Amendments in the New Decree

The new decree n°2022-1183 introduces several significant changes that you should be aware of:

- Automatic currency transfer by the bank: The bank automatically transfers 70% of undeclared foreign currencies on the 31st day from the value date of the received transfers.

- Closure of foreign currency accounts: The bank will close foreign currency accounts of entities that do not meet the criteria outlined in the decree. This must be done within six months from the publication of the decree, which was posted on the MEF website on December 22, 2022.

- Opening of foreign currency accounts: Opening a foreign currency account is reserved for exporters of goods and services. This also applies if you are an online seller, a non-resident, a financial institution, or a currency exchange office.

- Justification of transfers abroad: All transfers abroad must be justified.

Summary of the New Provisions

The chart below summarizes for you, the new amending provisions of this Decree.

Our team offers you ongoing updates on the evolution of financial regulations in Madagascar. You too can become a client of MDG Services by entrusting us with your projects in Madagascar, including the opening of bank accounts. If you need assistance with procedures related to foreign currency accounts, especially for exports, we are here to help.