Firstly, the synthetic tax is a single tax, representative and in full discharge of the income tax and the value added tax. Then, it is the main mandatory annual tax return for any income generated in Madagascar.

In other hand, the tax threshold in force is the turnover or gross income or gain acquired by the taxpayer during the fiscal year, lower than Ar 200,000,000 according to the current Finance Law.

Some definitions and clarifications to better understand tax terms

- Definition of “gross income”: Income received before payment of any expenses. It represents the total income received throughout the year.

- The term “gain” means any sum of money earned by the self-employed person: gifts received, penalties received, capital gains from the sale of company assets, etc.

- Clarification of the notion of realization of the turnover declared to the IS: collection of a sum of money corresponding to the sales made or the services provided

The taxable base of the Synthetic tax

Moreover, the taxable base of the Synthetic tax is the realized turnover or gross income or gain acquired during the closed fiscal year of the previous year.

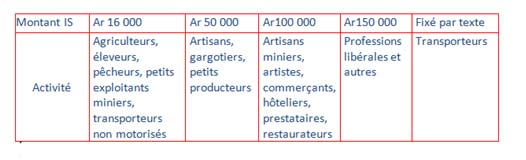

Determination of the corporate income tax :

Synthetic tax = Turnover x 5%.

Minimum tax rate

Tax deadline and documents needed

Besides, the deadline for payment of the synthetic tax is March 31 of each year. Renewal of the tax card is the next step after the payment of the Synthetic tax.

The main files to be provided to have an updated tax card are :

-Photocopies of the synthetic tax payment slip

-Statistical card

-Taxpayer’s national identity card and eventually the files related to the activity (lease contract, license…). Also, tax identification number or NIF that was assigned to you at the time of your tax registration or the creation of your company. It remains unchanged, even if the tax card or CIF changes every year.

If you wish to entrust us with the management of your tax returns, please contact us by e-mail at: contact@madagascar-services.com