Madagascar is part of the country with a great economic potential with a diversified natural resource, a market not yet saturated and an abundant workforce. All these qualities attract investors and businessmen.

As the most promising sectors of the economy: mining, tourism, textiles and renewable energy. But more particularly the textile sector which benefits from a special tax regime, with the approval in Free Zone, offering interesting tax advantages, as well as the renewable energies with an exemption to the VAT.

It should be noted that there are at least three phases to be respected before a company is legally constituted, namely: the pre-creation phase, the constitution of files and the filing of files.

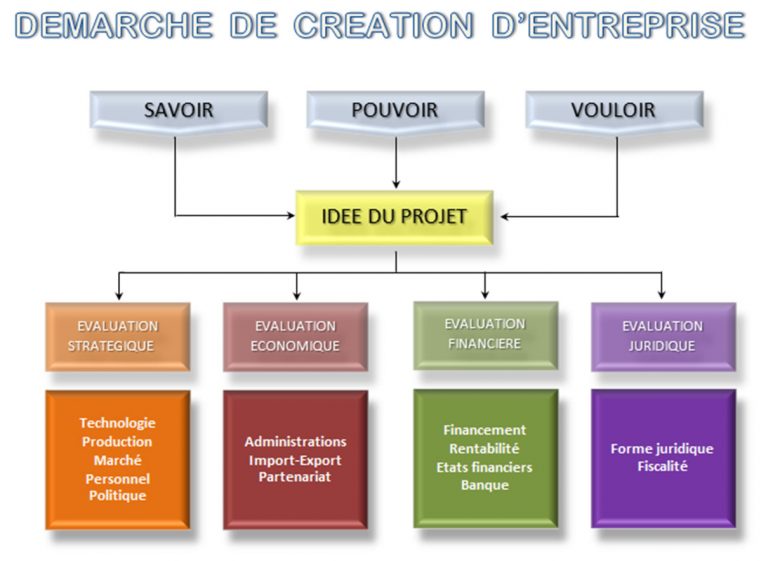

1-Pre-creation phase

Before starting your business, it is important to carry out various studies and evaluations based on the forecast elements related to the project.

- The activity: after having carried out a market study, it will be necessary to find out if the activity in view is regulated. In this case, the opening of the company acquires an authorization.

- The legal status: having a comparative state of the main legal statutes is very important. Indeed, the advantages and disadvantages of each type of status will allow you to make the right choice. Also, the size of the project determines the structure to be created. The most important projects gathering several shareholders and important capitals are the object of a status of Limited Company or SA. As for intermediate projects, it is better to opt for the Limited Liability Company or SARL. While small-scale projects are better directed towards the creation of an Individual Company.

- The administration: the constituent elements of the General Assembly (GA) or the Board of Directors (CA) depend on the legal status of the company. For the SARL, the GA is constituted by the manager and the partners while for the SA, there is the General Administrator and the Board of Directors. The General Assembly allows to have a visibility on the functioning of the company and the decision making during the life of the company. Note that a structure established in Madagascar must be represented by a representative of Malagasy nationality or holder of a valid resident card. Outsourcing firms offer a local management option, like MDG SERVICES.

- The tax system: the projected turnover determines the tax system of commercial companies in Madagascar. With the Malagasy tax provisions in force, there are only two tax systems: the system under the Synthetic Tax (IS) and the system under the Income Tax (IR). A simulation of the main taxes to be paid is necessary to refine the business plan, key element to launch a project.

Having a close and attentive accompaniment will help you more in order to give you advice tailored to your project.

2-The creation of files

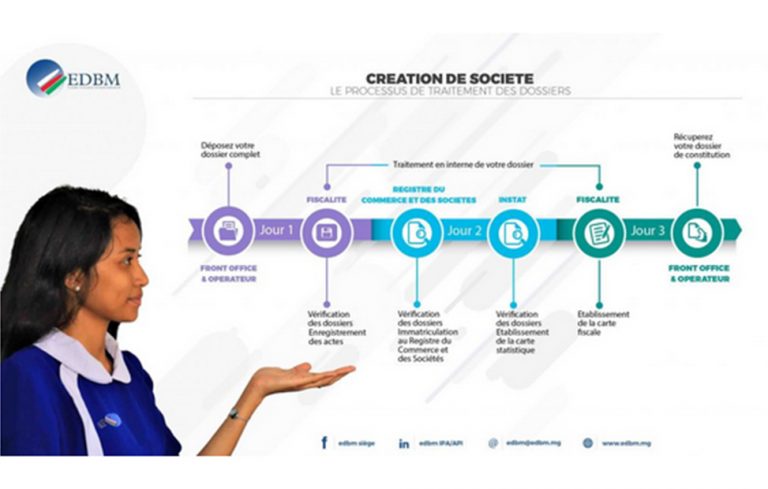

A single desk competent mainly for the creation of companies manages the documents related to the opening of a company known as the Economic Development Board of Madagascar (EDBM)

The main files to be filed with the EDBM :

- The articles of association of the company specifying the company name, the address of the headquarters, the legal form.

- The use of the premises (lease or rental contract with proof of ownership from the lessor, location plan)

- A prior authorization for regulated activities.

- Any act issued at the time of incorporation

- Legal status

When creating your company, the choice of the legal form (SA, SARL, EI…) is eminent insofar as it determines the responsibility of the associates with regard to the debts contracted by the company.

In a sole proprietorship or a limited partnership, for example, the partners are jointly and severally liable for the debts contracted by the company, whereas by opting for the corporate form, the liability of the partners is up to their share in the company.

- Regulated activities

In addition to the documents that you will be asked to provide when you create your company, make sure you have prior authorization for regulated activities such as tourism, financial, health, education, etc…

Indeed, given their specificity, some activities require a prior authorization from the competent authorities when creating the company.

In the case of a restaurant, for example, compliance with an international standard is a prerequisite for obtaining authorization to open. The premises must have a main entrance, a private toilet, a qualified staff, a kitchen, waste treatment…

- Lease or rental agreement

Every company in the process of incorporation must have a registered office address and a place of business address. The two addresses can be the same or different. As for the registered office, it can be determined by a domiciliation contract. The advantage of domiciling the registered office at a fixed place of business is that the address in the administrative, tax and legal files of the company remains unchanged, even if the place of business changes.

In any case, a lease agreement must be drawn up even when one of the partners makes his premises available to the company to serve as the company’s place of business.

The certificate of legal status (CSJ) of the property or the copy of the title deed which justifies that the lessor has acquired the land where the building is located, must be attached to the file when filing.

If the lessor is an heir and is not included in the certificate of legal status, the authorization of the co-heirs is required in addition to the deed of notoriety.

MDG Services has a “turnkey” offer to assist project sponsors in their creation process.

3-The submission of files

The company’s articles of association and minutes are registered when the files are filed.

The registration fee varies according to the act. For the articles of association, for example, the registration fee is 0.5% of the company’s capital with a minimum fee of 10,000 Ar, while the registration fee for the Company registered address contract is 2% of the total rent for the entire duration of the lease.

To know more about the fees payable when creating a company in Madagascar

The creation of a company is done in less than a week, after submission of complete files.